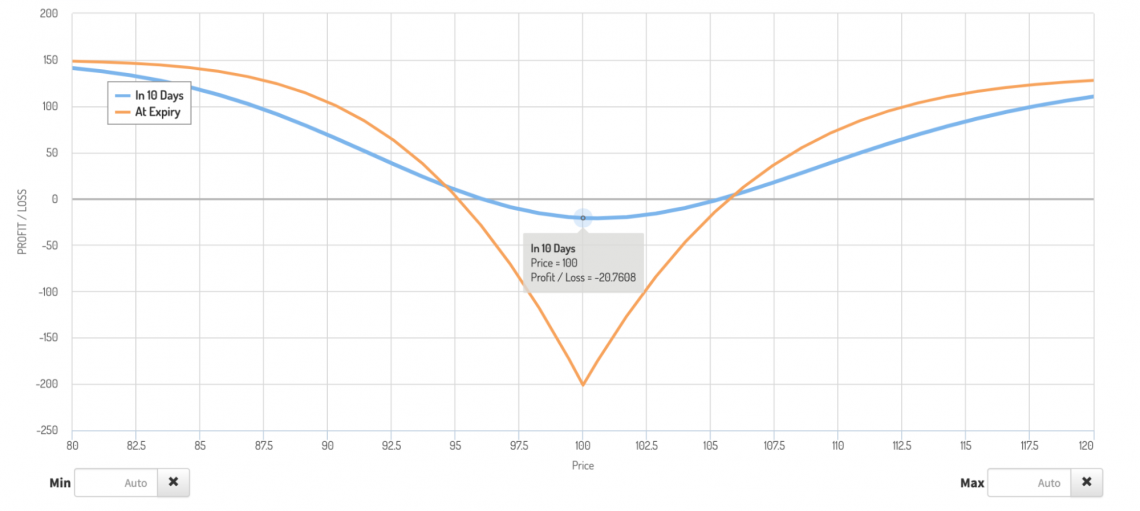

Reverse Calendar Spread Payoff Diagram. Max profit (assuming no volatility change) is a little less, at $186 compared to $221. The calendar spread payoff diagram is a useful way to visualize the potential risk and reward profile of the strategy and for.

Beyond that level, the payoff starts to increase until the underlying reaches the level of. The calendar spread, also known as a time spread or a horizontal spread, consists of option contracts based on the same underlying asset and the same strike prices but with.

The calendar spread, also known as a time spread or a horizontal spread, consists of option contracts based on the same underlying asset and the same strike prices but with.

The payoff diagram for a call diagonal spread is variable and has many different outcomes depending on when the.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)

Reserve Calendar Spread What does it mean, and how to use it? Wall, A calendar spread has a similar shaped payoff diagram to a short straddle but the maximum loss is limited whereas the maximum. This is achieved without the risk of.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit], The payoff diagram for a put calendar spread is variable and has many different outcomes depending on when the options trader decides to exit the position. This is the payoff diagram on july 9, one week prior to the short strike expiration.

Reverse Calendar Spread using Call Options YouTube, The payoff is zero as long as the underlying price is at strike x 1 or below. Find a broker or adviser.

Calendar Spread Option Strategy India CALNDA, The calendar spread payoff diagram is a useful way to visualize the potential risk and reward profile of the strategy and for. Call calendar spread payoff diagram.

Calendar Spread Explained InvestingFuse, The payoff diagram below shows the calendar spread on nifty created by using two legs of weekly expiries. The payoff diagram for a put calendar spread is variable and has many different outcomes depending on when the options trader decides to exit the position.

Calendar Spreads 101 Everything You Need To Know, Call calendar spread payoff diagram. The payoff diagram for a put calendar spread is variable and has many different outcomes depending on when the options trader decides to exit the position.

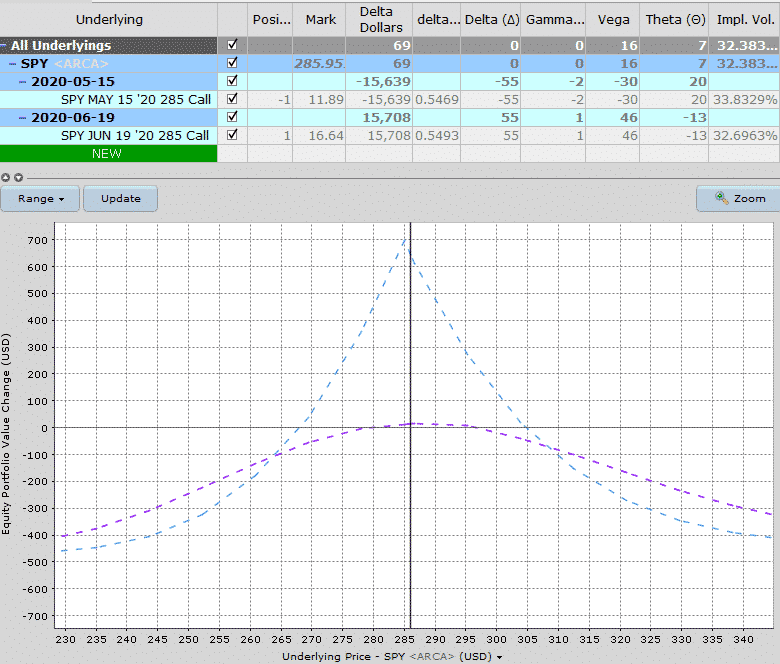

Calendar Spreads Option Trading Strategies Beginner's Guide to the, Here’s a payoff diagram for this calendar spread: This strategy involves buying and selling contracts at the same strike price but.

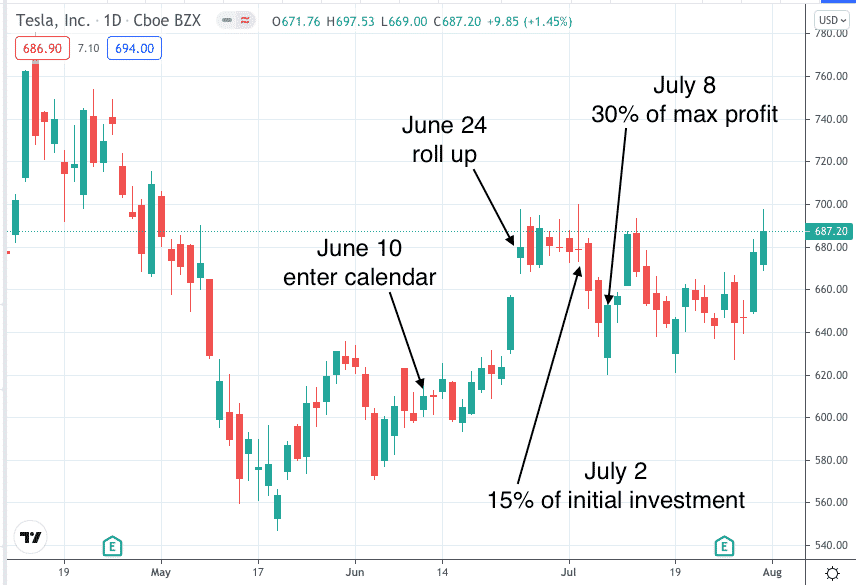

Adjusting Calendar Spreads 2025 Ultimate Guide, Call calendar spread payoff diagram. The payoff diagram for a call calendar spread is variable and has many different outcomes depending on when the options trader decides to exit the position.

Volatility Convergence, Reverse Calendar Spread for TVCVIX by, Here’s a payoff diagram for this calendar spread: The blue dotted vertical line represents the underlying spot price.

Interactive, RealTime Option Payoff Diagrams Option Alpha, The payoff diagram for a call diagonal spread is variable and has many different outcomes depending on when the. A reverse calendar spread, also known as a short calendar spread, is an options strategy that involves multiple legs.